Protecting COMMUNITIES IS protecting ASSETs

WHAT IS THE CRA?

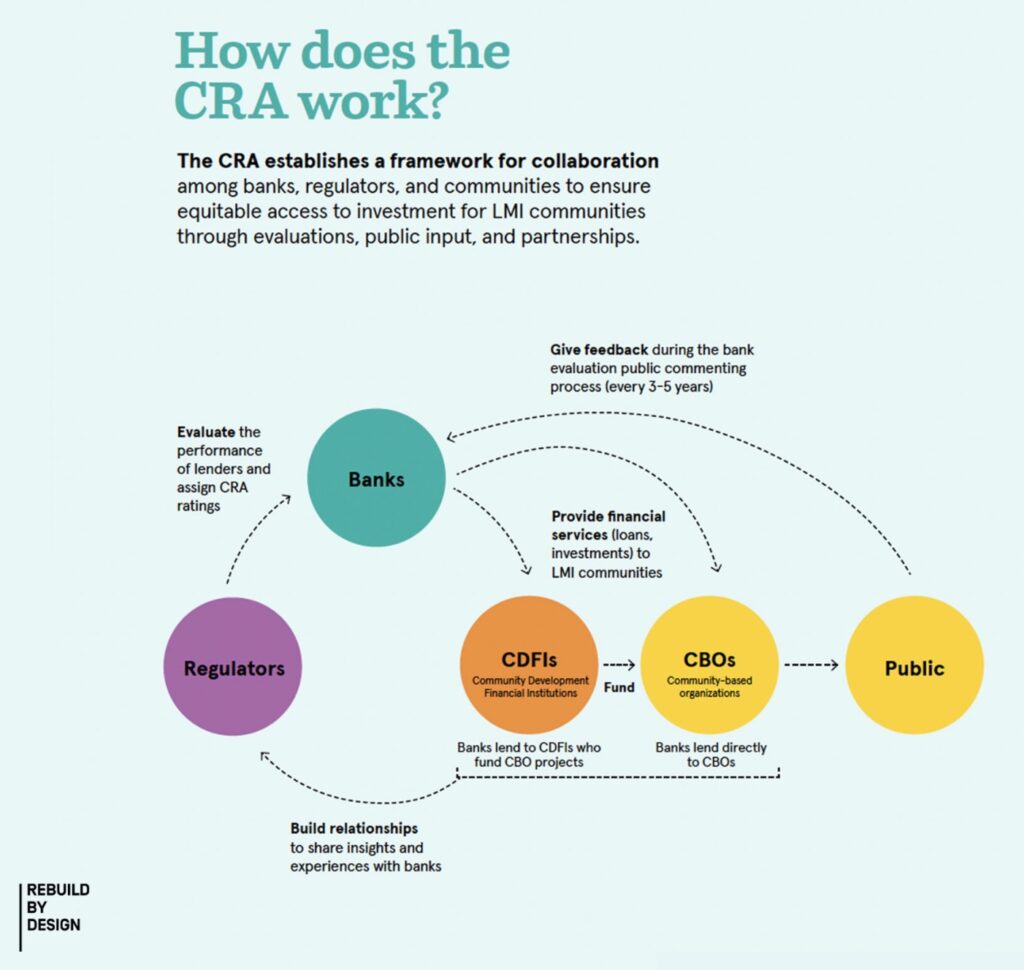

The Community Reinvestment Act (CRA) is a 1977 federal law that encourages banks to meet the credit needs of the entire community, particularly low- and moderate- income (LMI) neighborhoods, to combat redlining.

OPPORTUNITY

Extreme weather risk is a financial risk. Between 2011-2024, 99.5% of congressional districts experienced at least one federally declared major disaster due to extreme weather, and cost taxpayers $117.9 billion dollars in federal relief (Atlas of Disaster, 2025).

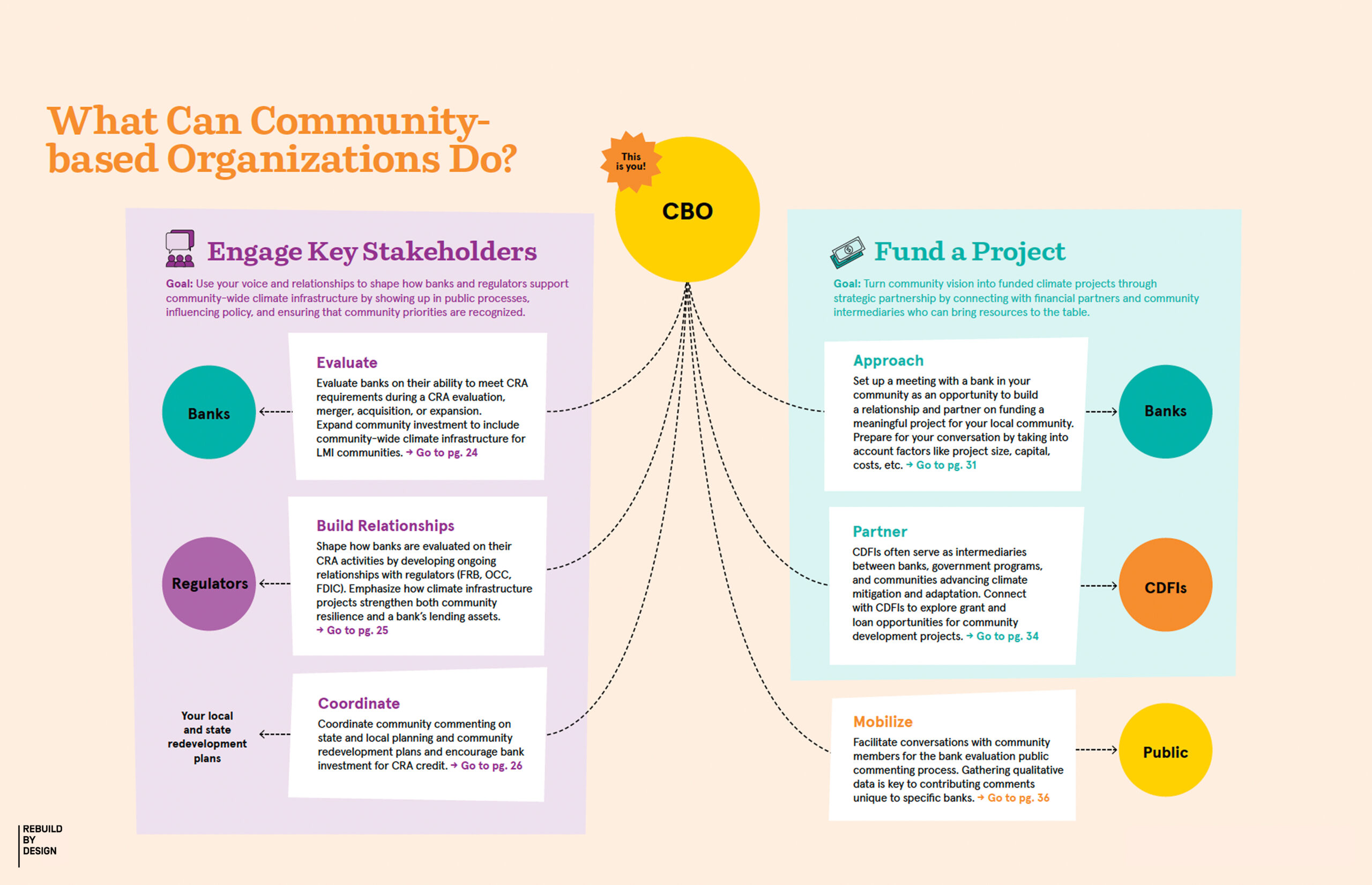

The Community Reinvestment Act (CRA), designed to combat the economic effects of redlining, has long supported investments in affordable housing, small businesses, and community development, but its potential for addressing extreme weather challenges is underutilized. To address this gap, Rebuild by Design created a CRA Community Guide and a CRA Bank Guide to educate banks and community-based organizations on how to work together and proactively leverage the CRA to finance community-wide infrastructure before extreme weather strikes.

Community-based organizations and banks can use these guides to:

- Demystify the CRA process

- Learn how to leverage CRA to fund community-wide infrastructure

- Develop strategies to build relationships with both financial institutions and community stakeholders

Protecting communities is protecting assets. Together, banks and community-based organizations can use CRA to shift investment from reactive, post-disaster recovery to proactive, community-informed infrastructure that stabilizes assets, reduces risk, and strengthens local economies.

WHAT IS COMMUNITY-WIDE INFRASTRUCTURE?

Neighborhood to large-scale projects that reduce risks of extreme weather hazards and sea level rise, while supporting everyday well-being. For example: a park that captures rainwater during a flood event, but also serves as a community space.

KEY INSIGHTS

Extreme weather risks are financial risks

Between 2011 and 2024, 99.5% of congressional districts experienced at least one federally declared major disaster due to extreme weather, costing taxpayers $117.9 billion in federal relief (Atlas of Disaster, 2025).

protecting communities protects bank assets

Community resilience and bank stability are mutually beneficial. Together, banks and community-based organizations can shift investments from reactive to proactive community-informed infrastructure that stabilizes assets, reduces risk, and strengthens local economies.

57% of Disaster-Declared U.S. Counties are CRA-eligible

57% of counties in the contiguous U.S. that received a disaster declaration between 1998-2018 contained at least one census tract where banks may receive Community Reinvestment Act (CRA) credit (Keenan and Mattiuzzi, 2025).

Investing in disaster resilience = avoided financial losses

Every $1 invested in resilience and preparedness saves $13 in avoided damages, cleanup, and $33 in avoided economic losses. (U.S. Chamber of Commerce Foundation, 2025).

CRA investments offer an opportunity to reduce risk exposure for banks and communities

While CRA has traditionally supported housing, small businesses, and community development, there is an opportunity to leverage it for proactive, community-wide infrastructure. Qualifying activities such as flood control, and stormwater systems are eligible under existing regulations.

Infrastructure investments are strongest when shaped by community expertise

Developed with residents in Denver, CO and Charlotte, NC, Rebuild by Design distilled 10 community-informed principles to guide community-wide infrastructure investments.

check out our research guidebooks:

community guide

Created in collaboration with Center for Urban Pedagogy to equip community-based organizations working to build resilience in low-to-moderate income communities, with the knowledge to engage banks and regulators to support community-wide infrastructure investments. Read the guide>>

bank guide

Underscores the shared interest between financial institutions and the communities they serve: lowering risk from extreme weather. This guide aims to help institutions strategically direct their CRA investments toward projects that strengthen community-wide infrastructure in low-to-moderate communities. Read the guide>>

Case studies

Created in collaboration with our NYU Capstone Team to understand the best opportunities for private investment into resilience projects across different hazards, and at different scales. Read the report >>

RECOMMENDATIONS

MEET OUR ADVISORY BOARD

CASHAUNA HILL

Executive Director, The Redress Movement

KEVIN HILL

Senior Policy Advisor, National Community Reinvestment Coalition

GREGORY LOPEZ

Senior Assistant Vice President Sustainability, Wells Fargo

JOHN MOON

President, Local Initiatives Support Corporation (LISC) Green

JOYCE COFFEE

Founder & President, Climate Resilience Consulting

MAXWELL CIARDULLO

Director of Research, The Redress Movement

MELANIE STERN

Director of Consumer Lending & CRA Officer, Spring Bank

PILAR FINUCCIO

Executive Director, Center for Urban Pedagogy

Special thanks to Andrea J. Wang for helping design the CRA Community Guide and to Ciel Ben-Adi for research support.